VC 3.0 – Re-inventing Start Up Capital (Again)

Last week, I had the opportunity to speak to a room full of Georgia Tech finance students. Knowing that many of them were interested in start ups, I decided to talk about the ways venture capital will change in the coming years.

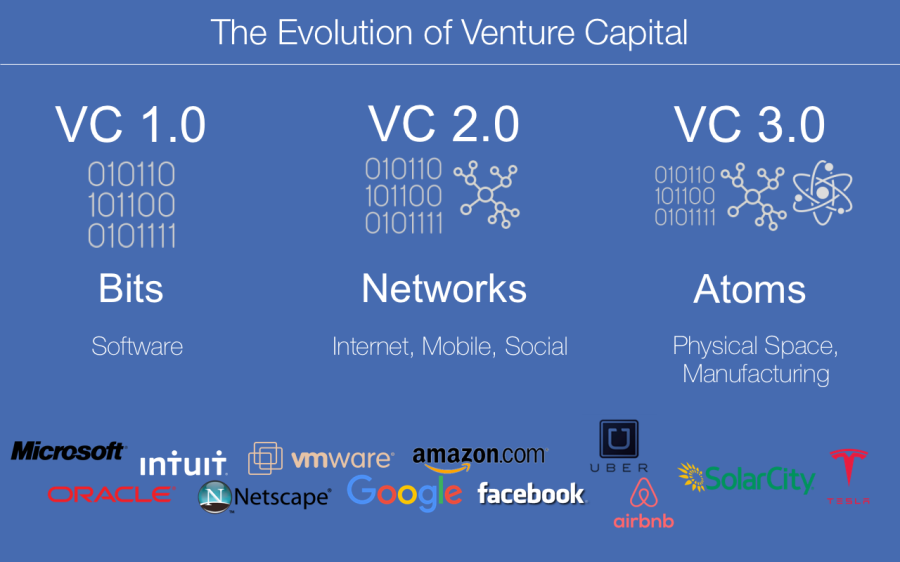

Over the last three to four decades, venture capital has gone through two major eras. The first was about software. Back in 80’s and early 90’s, raw functionality was more than enough to create value for users. If users could enter data and get reports, even if the experience was ugly, you made their lives better. The second era was about communications. In the late 90’s through the early 2010’s, venture capitalists shifted their investments to follow the value to users towards connectedness. The internet evolved into social which is now wrapped in mobile. Now, in the mid-2010’s, we are entering a third era: the physical world. Companies like Uber and Tesla are creating new platforms and incredible value by moving well beyond our phones and screens.

To put it simply, the shift from VC 1.0 to VC 2.0 to VC 3.0 is really just a shift from bits to networks to atoms.

This new, third era has big implications for the types of the capital required by start ups (hint: it’s not all about equity capital) and the kinds of financial skills needed by CFOs.

I thoroughly enjoyed speaking with the students. We had lots of great questions and discussions during and long after the presentation.

You can see the presentation on Slideshare or download the PDF here.

Good thoughts, Bill. This aligns well with Robin Chase’s (former CEO of Zipcar) “Peers Inc” view of the world…albeit from the other side of the VC table. See her talk here: http://www.inc.com/robin-chase/3-key-factors-that-make-startups-successful-in-the-sharing-economy.html